Everything you need to know before investing in Non-Fungible Tokens (NFTs)

Explore the exciting world of non-fungible tokens (NFTs) and discover what you need to know before investing in them. Learn about the unique characteristics of NFTs, their potential benefits and risks, and how to evaluate NFTs before making a purchase.

Everything you need to know about ETFs in India

Get a comprehensive overview of exchange-traded funds (ETFs) in India, including how they work, the different types available, and their potential benefits. Understand the laws and regulations governing ETFs in India and learn how to choose the right ETF for your investment goals.

Everything you need to know about NPS

Learn about the National Pension System (NPS) – a government-backed pension scheme in India. Understand the features, account types, tax benefits, withdrawal options and advantages of NPS.

How to choose between Provident Fund, Superannuation & NPS?

Learn how to choose the best retirement savings option in India between Provident Fund, Superannuation Fund and National Pension System. Understand the level of control, risk, tax implications and other factors to make an informed decision.

5 Steps to Selecting the Right Mutual Fund in the Indian Market

Learn how to choose the right mutual fund for your investment goals in the Indian market. Our guide covers key considerations such as risk tolerance, fund performance, fees, and portfolio diversification. Get started on your investment journey with confidence.

Everything You Need To Know About Cryptocurrency

Learn everything you need to know about this innovative form of digital currency. Discover how cryptocurrencies work, the different types available, and their potential benefits and risks. Understand the laws and regulations governing cryptocurrencies and learn how to securely buy, sell, and store them.

7 reasons to invest in NPS

Learn about the benefits of investing in the National Pension System (NPS) in India. From tax benefits to flexibility and professional management, this government-backed pension scheme is a great option for long-term retirement savings.

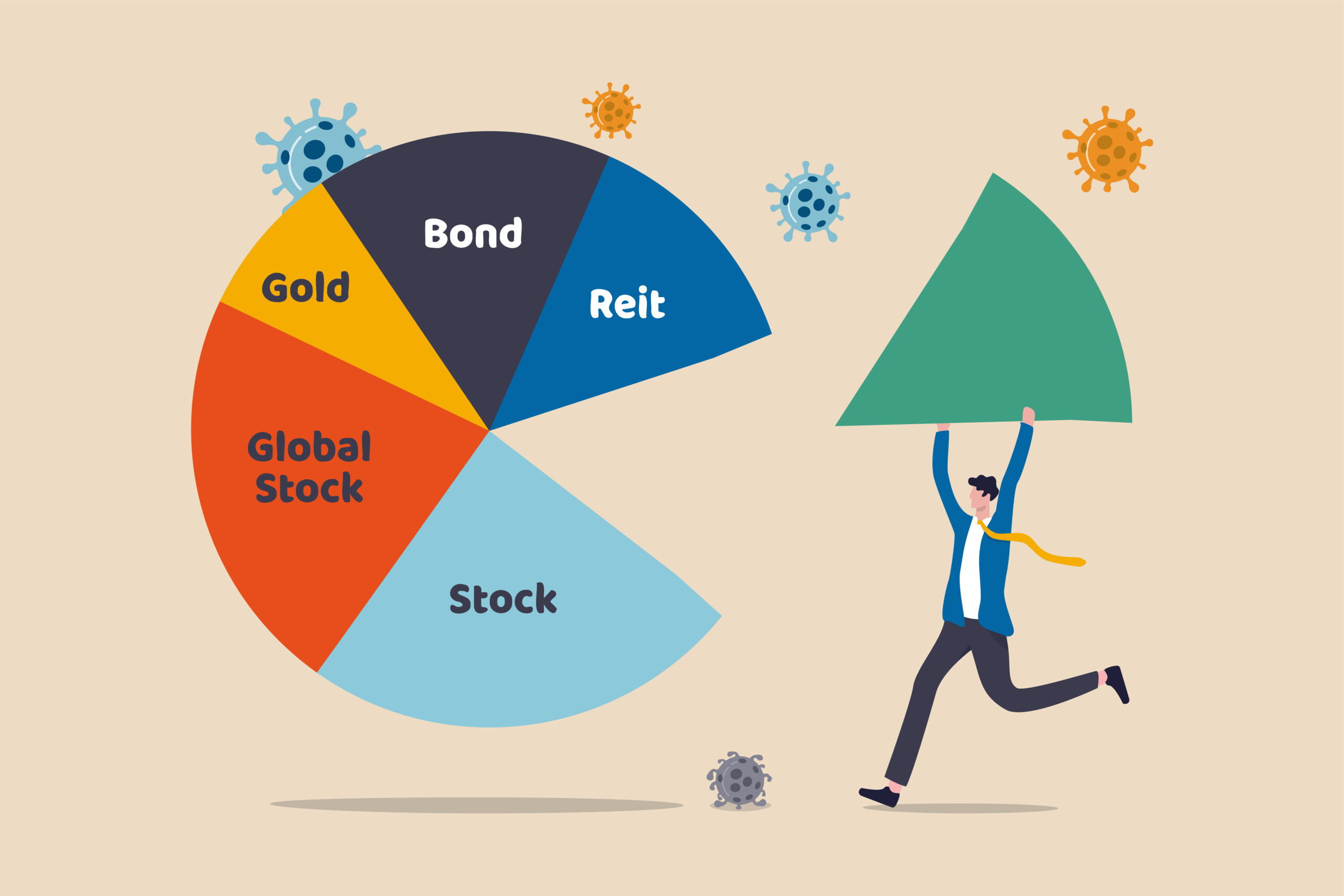

The Role of Bonds in a Diversified Investment Portfolio

Learn about the benefits of including bonds in a portfolio, types of bonds and factors to consider before investing. This article discusses the importance of having bonds in a well-diversified portfolio to balance risk and returns.

Investing in Real Estate: Pros and Cons for Investors in India

This blog post examines the pros and cons of real estate investment, including the potential for high returns, the use of leverage, and the risks of market fluctuations and illiquidity. We also discuss the time and labor required for property management.