Lessons from “The Little Book of Common Sense Investing” by John C. Bogle

Learn proven strategies for low-cost index funds, diversification, avoiding active management, patience, long-term investing, avoiding market timing, dollar-cost averaging, creating a well-defined investment plan, minimising taxes and keeping costs low.

“Mastering Money: Proven Lessons from Tony Robbins’ “Money Master the Game”

Learn proven strategies for setting goals, compounding, diversification, tax minimization, understanding fees, low-cost index funds, multiple streams of income, financial control, automation and finding the right financial advisor.

Discovering Your Number: A Guide to Planning Your Retirement

Unlock your ideal retirement with our guide based on Lee Eisenberg’s “The Number.” Assess your lifestyle, calculate retirement needs, and build a tailored financial plan. Embrace adaptability, diversify investments, and balance present enjoyment with future planning for financial success and peace of mind.

The Science of Getting Rich: Proven Lessons for Wealth and Prosperity

Achieve wealth and prosperity with “The Science of Getting Rich” by Wallace D. Wattles. Learn proven strategies for definite purpose, thought, action, gratitude, value, right action, persistence, imagination, self-discipline, and harmony.

Proven Lessons on Personal Finance from ‘I will teach you to be rich’ by Ramit Sethi

Master your finances with Ramit Sethi’s “I Will Teach You to Be Rich”. Learn proven strategies for automation, investment, income, mindset, negotiation, credit and more. Achieve financial freedom with actionable steps and expert advice.

The Power of Rational Investing: Lessons from “Your Money and Your Brain” by Jason Zweig

“Unlock the secrets to successful investing with “Your Money and Your Brain” by Jason Zweig. Learn how to overcome cognitive biases, understand the role of emotions, and adopt a long-term perspective.

The Total Money Makeover by Dave Ramsey: Proven Lessons for Mastering Your Finances

Discover practical strategies for budgeting, creating an emergency fund, reducing debt, planning for retirement, investing, saving for college, insuring yourself and building wealth.

Mastering Your Finances with Rich Dad: Lessons for Building Wealth and Financial Independence

Learn how to understand the difference between assets and liabilities, build a strong financial foundation, acquire assets, take calculated risks, build passive income, achieve financial independence, leverage, plan and network.

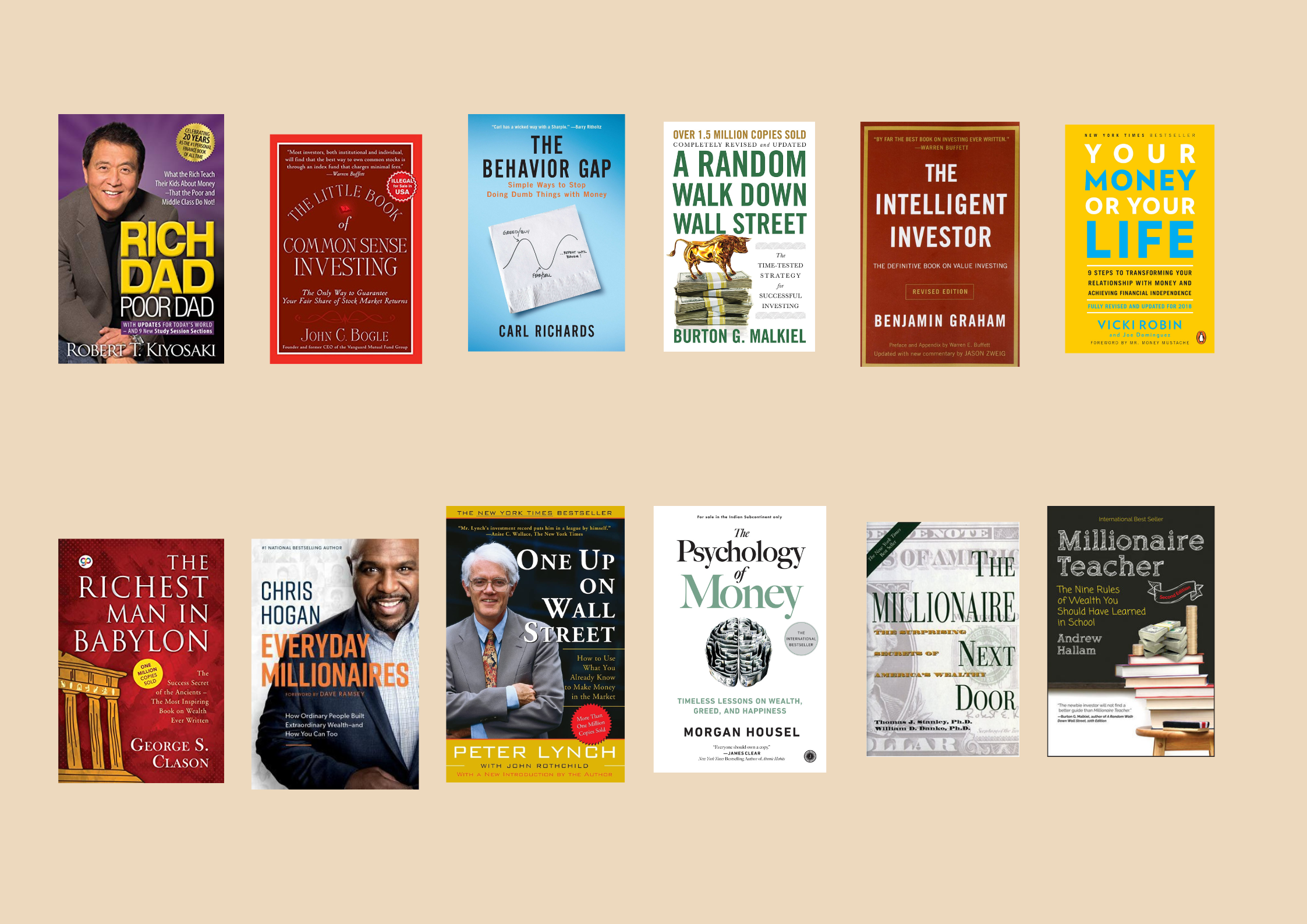

Lessons from the 12 best books on investing

Gain valuable insights into the world of finance with this collection of lessons from classic investment books. From “The Intelligent Investor” to “Rich Dad Poor Dad”, learn the principles of building wealth, managing debt, and making smart investment decisions.