Smart Beta Investing in India: Everything You Need to Know

Table of Contents

Smart beta investing is an investment strategy that has gained popularity in recent years and has become a hot topic in the Indian investment scene.

Smart beta investing uses a rules-based approach to select securities rather than relying on traditional market capitalization-weighted indices.

This blog will provide a comprehensive overview of smart beta investing in India, including what it is, how it works, the different types of smart beta strategies, the benefits and drawbacks of this investment strategy and the current scenario of smart beta investing in India.

What is smart beta investing?

Smart beta investing is an investment strategy that uses a rules-based approach to select securities.

It aims to provide investors with a better return than traditional market capitalization-weighted indices, such as the Nifty 50 or the BSE Sensex.

Smart beta investing is often described as a hybrid between active and passive investing, as it uses a rules-based approach to select securities, but it is still considered a passive investment strategy.

Unlike traditional index investing, smart beta strategies use factors other than market capitalisation to weigh the securities in the index.

How does smart beta investing work in India?

In India, smart beta investing typically involves selecting securities based on specific rules or factors.

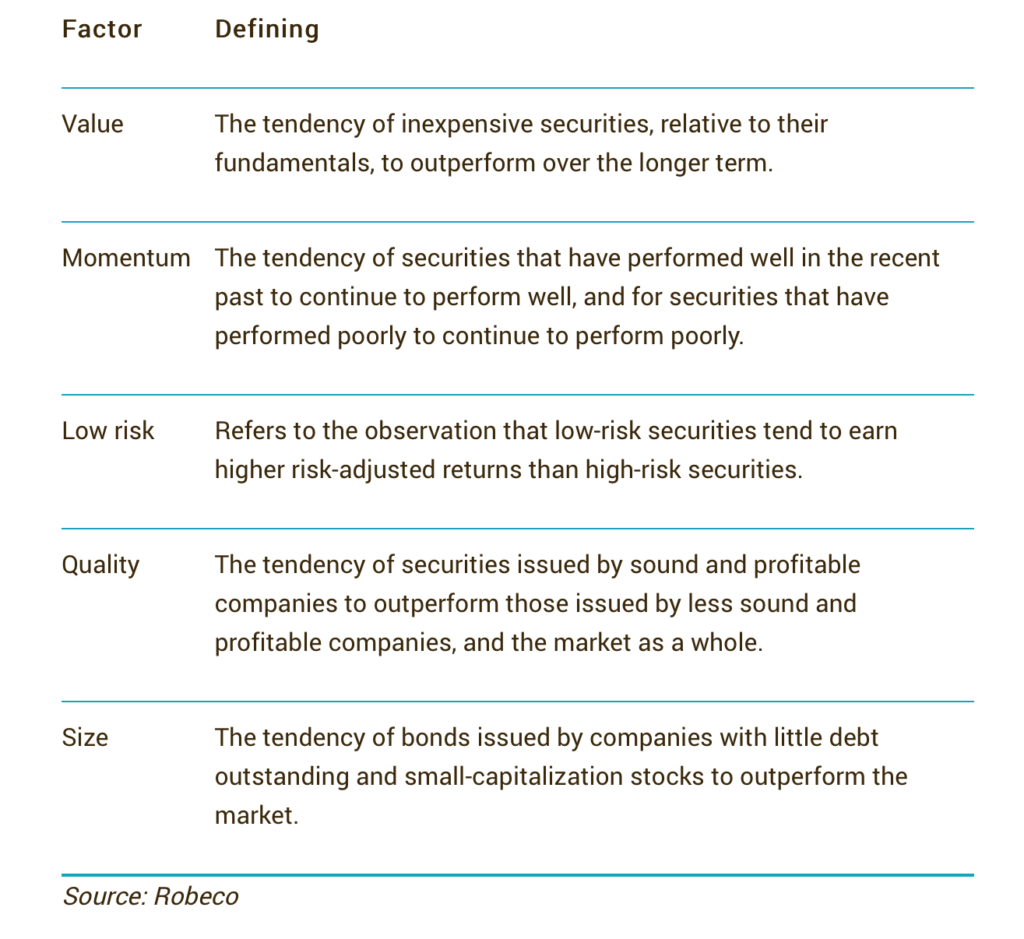

These factors can include things like value, momentum, quality, and size. The securities that are selected are then combined to form a portfolio.

Smart beta portfolios are rebalanced periodically to ensure that the securities continue to meet the selection criteria.

Different types of smart beta strategies

Several different types of smart beta strategies are available to investors in India.

Some of the most common include:

- Value: This strategy focuses on selecting securities that are considered undervalued by the market.

- Momentum: This strategy focuses on selecting securities that have performed well in the past and are expected to continue to perform well in the future.

- Quality: This strategy focuses on selecting securities with strong fundamentals, such as high-profit margins and low debt.

- Size: This strategy focuses on selecting securities that are considered to be small or mid-cap.

Benefits of smart beta investing in India

One of the main benefits of smart beta investing in India is that it can give investors a better return than traditional market capitalization-weighted indices.

This is because smart beta investing uses a rules-based approach to select securities, which can help to identify undervalued or under-researched securities that traditional market capitalization-weighted indices may overlook.

Additionally, smart beta investing can help investors with more diversification and lower volatility than traditional market capitalization-weighted indices.

It also gives investors more control over their portfolios by focusing on specific factors that they believe will drive returns.

Drawbacks of smart beta investing in India

While smart beta investing can provide investors with a better return than traditional market capitalization-weighted indices, it is not without its drawbacks.

One of the main drawbacks of smart beta investing in India is that it can be more complex and expensive than traditional market capitalisation-weighted indices.

This is because smart beta investing requires a more active approach to security selection and portfolio management.

Additionally, smart beta investing can also be riskier than traditional market capitalisation-weighted indices, as it relies on a specific set of rules or factors which may not always be accurate.

Also, it’s important to note that smart beta strategies don’t always outperform traditional indices, and they tend to have higher expense ratios.

Current scenario of smart beta investing in India

Smart beta investing is still a relatively new concept in India, and its popularity is still rising.

However, it is becoming increasingly popular among institutional and retail investors looking for an alternative to traditional market capitalisation-weighted indices.

The Indian market is still in the early stages of development in terms of smart beta products. However, more and more asset management companies are launching smart beta funds.

SEBI has also introduced regulations for smart beta funds to provide more clarity and protection for investors.

The trend of smart beta investing in India is expected to continue to grow in the coming years as investors become more familiar with the concept and the potential benefits it can offer.

Conclusion

Smart beta investing is an investment strategy that has gained popularity recently and has become a hot topic in the Indian investment scene.

It uses a rules-based approach to select securities rather than relying on traditional market capitalisation-weighted indices.

Smart beta investing in India can provide investors with a better return than traditional market capitalisation-weighted indices, but it is also more complex and more expensive.

Additionally, it can also be riskier than traditional market capitalisation-weighted indices.

Investors should carefully consider the benefits and drawbacks of smart beta investing before making any investment decisions. It is important to do a thorough research, understand the smart beta strategy, the underlying factors and the fund management before investing in smart beta.