The Role of Bonds in a Diversified Investment Portfolio

Table of Contents

Bonds are a type of fixed-income investment that can play a crucial role in diversifying and stabilizing a portfolio.

They are issued by governments, municipalities, and corporations to raise funds and are typically considered to be less risky than stocks. In this article, we will examine the role of bonds in a portfolio and how they can be used to achieve specific investment goals.

First, it is important to understand the basics of how bonds work. When an investor purchases a bond, they are essentially lending money to the issuer in exchange for regular interest payments and the return of the principal at maturity.

The interest rate, also known as the coupon rate, is determined at the time of issuance and remains fixed throughout the life of the bond. The bond’s price, however, can fluctuate depending on changes in interest rates, the issuer’s creditworthiness, and the bond’s remaining maturity.

The Role of Bonds in a Portfolio

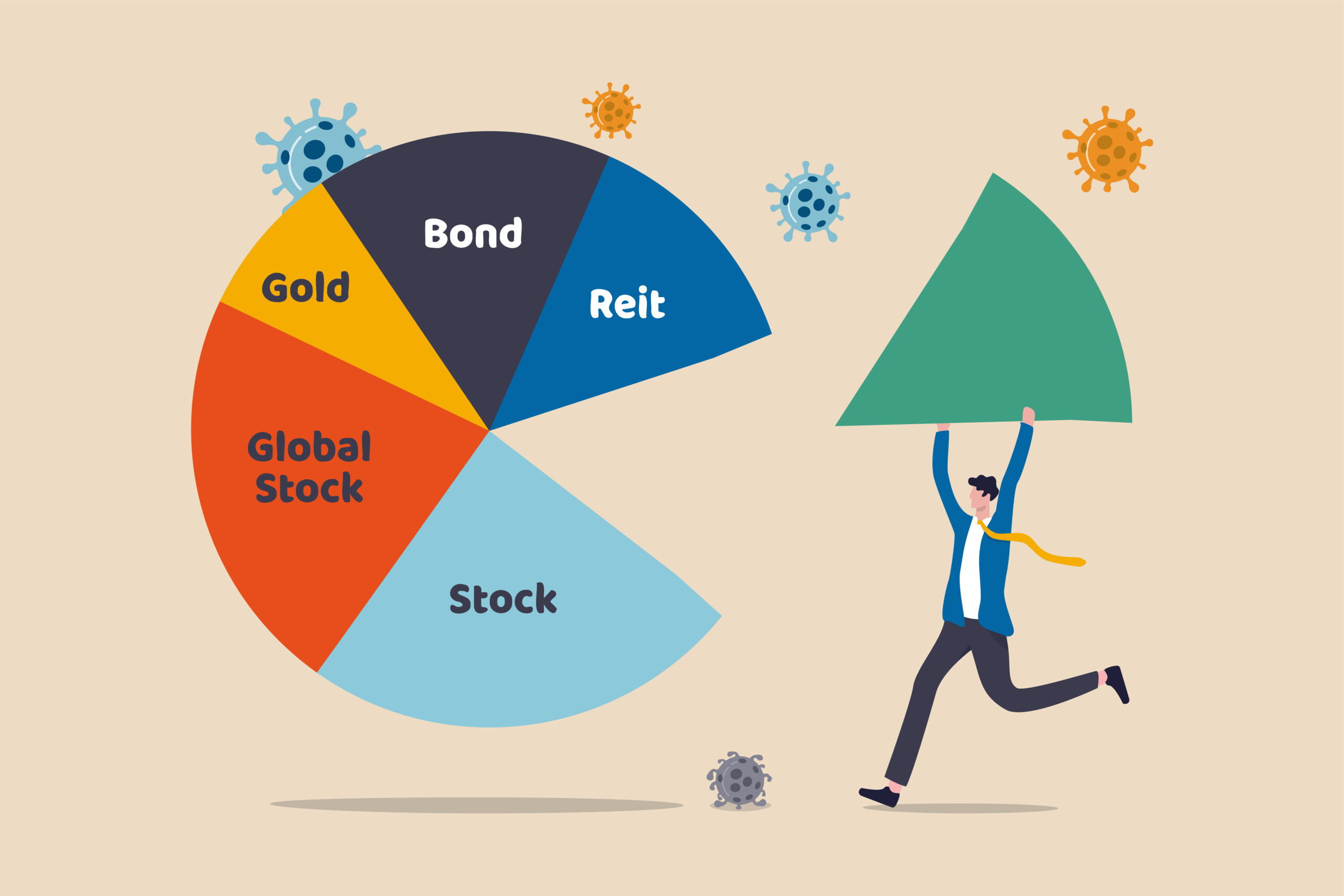

Diversification: Bonds can be an effective tool for diversifying a portfolio, as they tend to have a low correlation with other asset classes, such as stocks. This means that when stocks are performing poorly, bonds can potentially provide a buffer against losses.

Income: Bonds offer a steady stream of income through the form of interest payments. This can be especially beneficial for investors who are nearing or in retirement and are looking for a reliable source of income.

Risk reduction: Bonds are considered to be less risky than stocks, as they are generally considered to be more stable. Additionally, government bonds are considered to be among the safest investments, as they are backed by the full faith and credit of the issuing government.

Preservation of Capital: Bonds are considered to be a safer investment than stocks, and therefore, they can help to preserve capital during times of market volatility.

Inflation Protection: Bonds, particularly those with longer maturities, can help protect against inflation. As interest rates rise, bond prices fall. However, the coupon payments on these bonds will be worth more in real terms as inflation increases.

Types of bonds in India

Government Bonds: These are bonds issued by the Indian government. They are considered to be among the safest investments as they are backed by the government’s ability to raise taxes. The Reserve Bank of India (RBI) also buys and sells these bonds in the open market, which helps maintain stability in the bond market.

Corporate Bonds: These are bonds issued by companies to raise funds for their business operations. Corporate bonds are considered to be riskier than government bonds, but they also offer higher returns. The rating of the company issuing the bond is an important factor to consider when investing in corporate bonds.

Municipal Bonds: These are bonds issued by municipalities or local governments to fund infrastructure projects. These bonds are considered to be less risky than corporate bonds but riskier than government bonds.

Tax-Free Bonds: These are bonds issued by government-owned companies and municipalities that offer tax exemptions on the interest earned. These bonds are popular among investors who are in the higher tax bracket, as they provide a higher post-tax return.

Floating Rate Bonds: These bonds have a variable interest rate that is linked to a benchmark rate. These bonds are considered to be less risky than fixed rate bonds as the interest rate risk is borne by the issuer.

Infrastructure Bonds: These bonds are issued by companies engaged in infrastructure projects such as power, roads, ports, etc. These bonds are considered to be risky but offer higher returns as compared to other bonds.

Factors to Consider when Investing in Bonds

Credit Quality: The credit quality of the bond issuer is a key factor to consider. Bonds issued by companies or governments with high credit ratings are considered to be less risky than those issued by entities with lower credit ratings.

Maturity: The maturity of a bond is also an important consideration. Long-term bonds are generally considered to be more volatile and carry more risk than short-term bonds.

Coupon Rate: The coupon rate is the interest rate paid by the bond issuer to the bondholder. Higher coupon rates typically indicate that the bond is considered to be less risky.

Inflation: The rate of inflation is another important factor to consider when investing in bonds. If inflation is high, the value of a bond’s fixed coupon payments may decrease in real terms.

Taxation: Indian Tax laws, the income tax rate, and the taxability of the interest income from bonds are important factors to consider when investing in bonds.

Liquidity: The liquidity of the bond market is also an important factor to consider. Some bonds may not be easily traded and may be difficult to sell in a timely manner.

Credit Spread: The credit spread is the difference between the yield of a bond and the yield of a benchmark bond. A bond with a higher credit spread is considered to be riskier than a bond with a lower credit spread.

Default Risk: Default risk is the risk that the bond issuer will default on its debt obligations. This risk can be mitigated by investing in bonds issued by entities with a strong credit history.

The Role of Bonds in Managing Risk

Bonds play an important role in managing risk in a portfolio. They are considered to be less risky than equities and, thus, are used to balance out the volatility of a portfolio.

When stocks are performing poorly, bonds tend to perform better, and vice versa. This is because the value of bonds is not as closely tied to the performance of the economy as the value of stocks is.

In addition, the regular interest payments from bonds provide a steady stream of income, which can be especially important for retirees or other investors who need to generate income from their portfolios.

The inclusion of bonds in a portfolio can also help to reduce the overall volatility of the portfolio, which can be beneficial for investors who are risk-averse.

Bonds can play an important role in a well-diversified portfolio by providing diversification, stability, and a fixed income stream. However, it’s important to understand the risks involved and to choose bonds that are appropriate for your investment goals and risk tolerance.

Additionally, for tax saving and tax benefit purposes, it’s important to know the different tax saving bonds available and accordingly invest in them.