Breaking Down the Fees: A Comprehensive Guide to Understanding Financial Product Costs

Table of Contents

The money you pay to invest significantly impacts how much money you have left in your pocket.

“It turns out that fees are the only factor that reliably predicts a fund’s performance. The higher the expense ratio—the cost of owning the fund—the worse the performance for the investors. This is a case where you get what you don’t pay for.”- Carl Richards(The Behaviour Gap)

Investment fees may not appear to be significant, but they mount up over time, compounding along with your investment gains.

In other words, you don’t just lose the small amount of fees you pay; you also lose any future growth that money could have had.

Why worry about the cost of investment?

- Costs directly impact your investment returns.

- Over time, the money you lose due to costs compounds (increases rapidly).

- Because high-cost investments must cover these charges, their performance lags behind that of low-cost investments.

Imagine you have 100,0000 invested. If the account earned 12% a year for the next 25 years and had no costs or fees, you’d end up with about 18500000.

If you paid 2% a year in costs, after 25 years, you’d only have about 11000000.

That’s right: The 2% you paid yearly would wipe out almost 40% of your final account value. 2% doesn’t sound so small anymore, does it?

A high cost can be justified if the investment consistently generates much higher returns than low-cost options.

Every investment has a cost. However, how much you pay for your investments and to whom is entirely up to you.

Cost of Investing in Mutual funds

Expense ratios

This expense is measured as a percentage of the amount you have invested—for example, 2.25%.

It will not appear on your statement because it is deducted from your returns before they reach you.

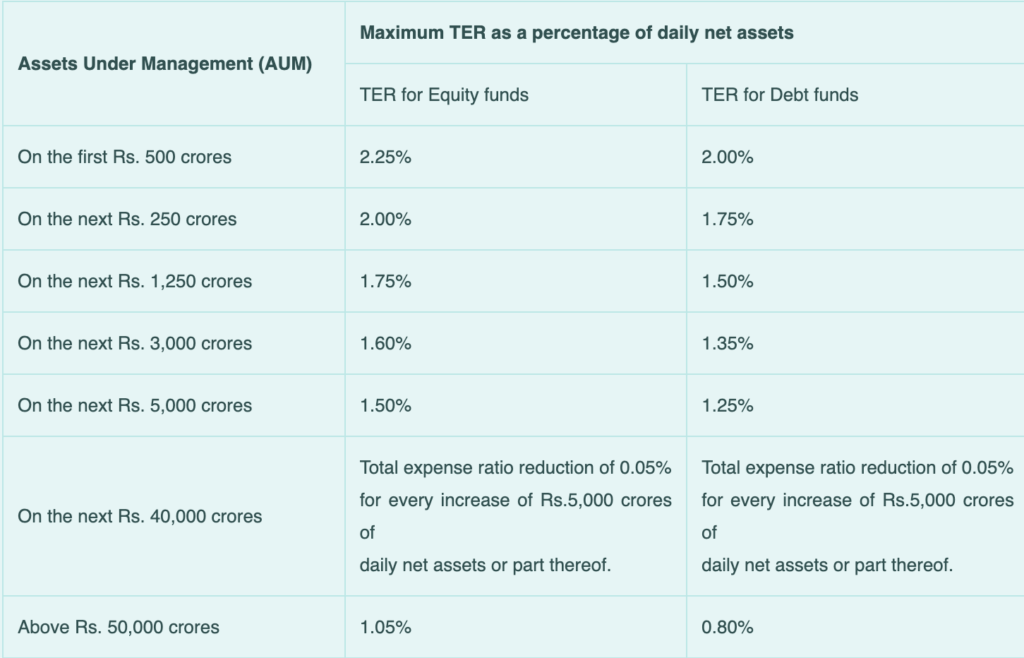

Source AMFI *TER is Total Expense Ratio.

So, for example, when your fund return 12%—and your expense ratio is 2.25%, you’ll only see a 9.75% return, meaning you’ll lose almost one-fifth of your return right away.

The money generated by the mutual fund expense ratio is sent directly to the fund to cover management and administrative expenses, which can vary greatly depending on the fund and firm.

You can save some part of this expense by buying Direct plans(without marketing expenses) of these mutual funds.

Exit Load

Mutual funds have an exit load in the range of .5%-2%. It is charged if investors withdraw from a scheme partially or completely within a set period (usually one year) from the date of investment, as specified in the Scheme Information Document. Some schemes don’t charge exit load.

Cost of Investing in ETFs

Expense ratios

This expense is measured as a percentage of your invested amount—for example, 0.10%.

So, for example, your ETF might return 9%—but if your expense ratio is 0.10%, you’ll see an 8.9% return, which is better than mutual funds.

The expense ratio in most of the ETFs in India is in the range of 0.1%-0.2%; therefore, these are cost-efficient compared to actively managed mutual funds.

Bid-ask spreads

When trading, the difference between the highest price a buyer is willing to pay at the time of purchase and the lowest price a seller is willing to receive at the time of sale.

It’s also a good measure of liquidity. The spread will stay very narrow for very liquid ETFs—those with many buyers and sellers at any given moment. The spread can be much wider for ETFs that don’t trade frequently.

Brokerage

These costs are charged when you buy or sell securities from the broker. While all ETFs technically have a commission, you may avoid it by buying them directly from the provider or with zero brokerage services.

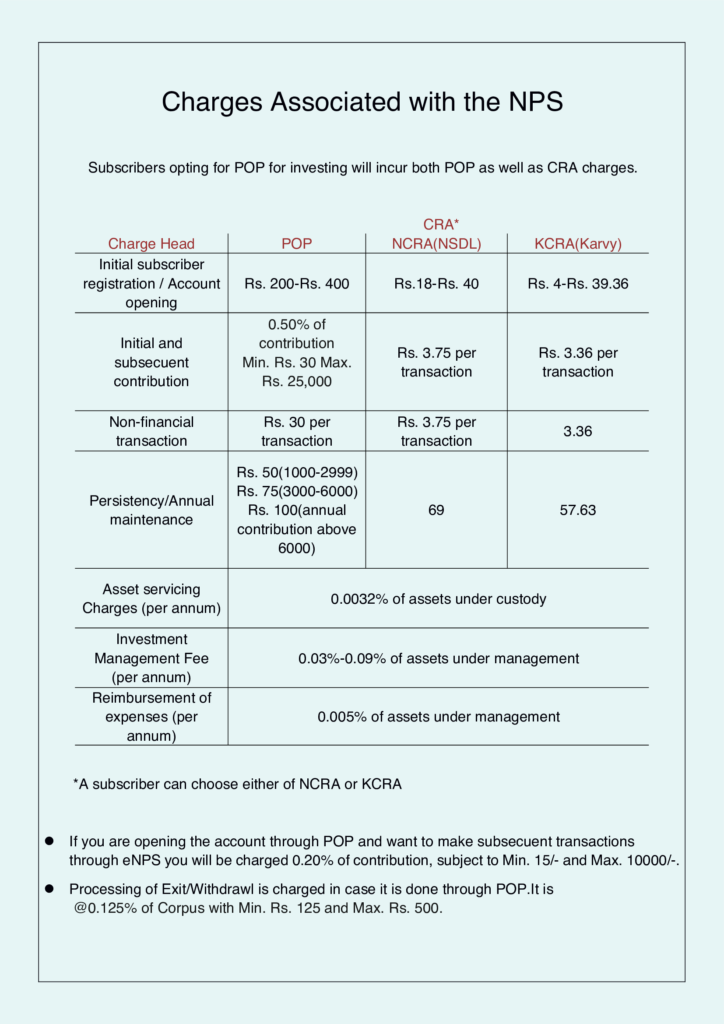

Cost of Investing in NPS

National Pension System (NPS) is a Government of India initiative to develop a sustainable and efficient voluntary defined contribution Pension System in India.

You can open an NPS account either through a point of presence (POP) or directly through the Central Record Keeping Agency (CRA).

You must note that CRA charges are bound to happen, whether you choose to open the account through a POP or not. A POP is simply an intermediary between you (the subscriber) and the CRA.

Although it is possible to make subsequent deposits directly to the CRA through eNPS after opening the account through a POP, a trail commission is passed to the POP, and a transaction charge of 0.20 per cent is charged.

Cost of Investing in Direct Equity Stocks

Bid-ask spreads

When trading, the difference between the highest price a buyer is willing to pay at the time of purchase and the lowest price a seller is willing to receive at the time of sale.

Brokerage

These costs are charged when you buy or sell securities from the broker.

Cost of Investing in Bonds and CDs

Bid-ask spreads

When trading, the difference between the highest price a buyer is willing to pay at the time of purchase and the lowest price a seller is willing to receive at the time of sale.

Commissions

For bonds and CDs, commissions can vary depending on whether you buy on the primary or secondary market. They may be levied based on the face value or per transaction.

Cost of Investing in PMS/AIF/Alternate Investments

Setup Fees

These charges are decided at the time of investment and are vetted by the investor.

Most PMS schemes levy a setup fee or entry load, which ranges between 1% and 3%. These charges cover the broker’s commission selling the PMS and can be reduced through negotiation.

FMC

Fund management fees can range from 1% to 3% at the high, which varies greatly depending on the PMS provider. These PMS costs are levied to the PMS account every quarter.

Profit Sharing

Not all PMS schemes charge this fee, but some of the most aggressive names in the market do demand a percentage of the client’s gains. Most PMS schemes charge profit-sharing fees in addition to the fixed FMC.

Profit sharing is only available for profits above the threshold. The PMS, for example, can state that there will be no profit sharing up to 10% returns. On the other hand, anything exceeding 10% returns would be divided 80:20 or any other pre-defined ratio between the client and the PMS.

Exit Load

The exit load is levied if the customer chooses to exit the PMS before a threshold of 1-3 years. Normally, there is no exit load if the client stays in the PMS for more than three years. It is divided into different slabs.

3% – If withdrawn before 12 months

2% – If withdrawn before 24 months

1% – If withdrawn before 36 months

Cost of Investing in ULIPs

Premium Allocation Charges

It is calculated as a percentage of the yearly premium. It includes costs such as underwriting, agent’s commission, etc. After subtracting these fees, the remaining funds are invested in the selected fund. Say your premium allocation charge is 10 per cent and your total premium is Rs 50,000. Then, Rs 5,000 will be deducted by the insurer as a premium allocation charge, and Rs 45,000 will be invested.

Administration Charges

The insurer charges a monthly fee for administering your insurance. These fees are deducted by cancelling units from each specified fund in proportion. This will either be the same throughout the tenure or vary at a prescribed rate.

Fund Management Charges

These charges are imposed for managing your funds. The insurer charges a percentage of the fund’s value, which is deducted before calculating the fund’s net asset value.

Surrender or Discontinuance Charges

These are levied when an insurer prematurely surrenders ULIPs. In the event of policy discontinuation, an insurer may only recoup the incurred acquisition cost, according to IRDAI regulations. They are a percentage of the fund’s value or premium. Surrender charges in ULIPs will range between Rs 1000 and Rs 2,000 for the first four years, depending on the year he surrenders. There are no surrender charges after the fifth year.

Partial Withdrawal Charges

From the third year onwards, investors are allowed to partially withdraw from some ULIPs, subject to pre-specified conditions. However, such withdrawals attract penalty charges.

Mortality Charges

The insurer computes it based on your age, health risk, and the mortality table.

Switching Charges

An investor is permitted a certain number of free switches between different fund options per year. Following this, each switch would incur charges ranging from Rs 100 to Rs 500, depending on the insurer’s pricing structure.

Guarantee Charges

On ULIPs with high-NAV guarantees, insurers incur guarantee fees. These are paid by the insured in exchange for a guaranteed return. For example, if a ULIP offers a return of 120 per cent after ten years, you must pay guarantee charges.

Rider Charges

These are imposed on additional benefits purchased in addition to the standard plan. For example, you must pay additional fees if you choose a critical illness rider.

Miscellaneous Charges

It is a minor component of the charge structure. You must pay various fees, for example, if you switch the premium payment style from yearly to quarterly.

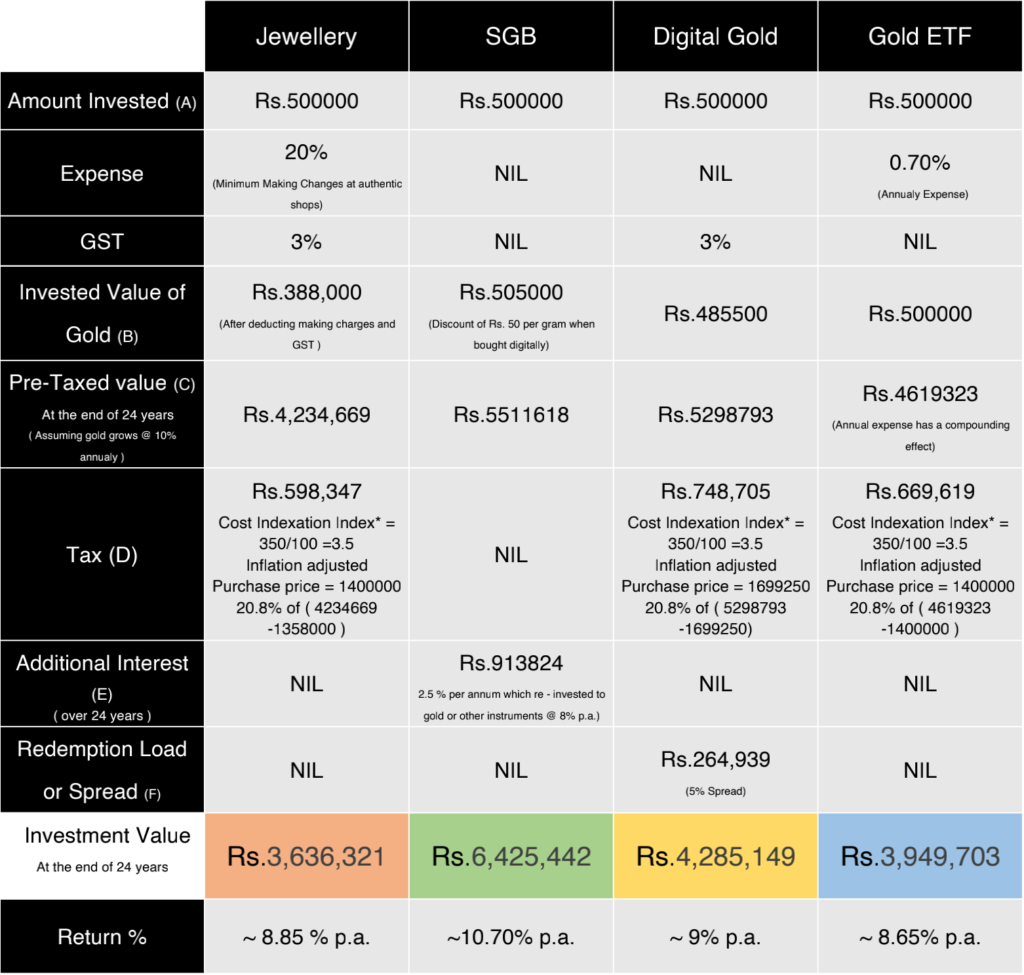

Cost of Investing in digital/physical Gold

Gold is the most desired asset that holds both social and emotional value for India Families. It has been a go-to investment for ages in India.

But most families, especially those who buy it as an investment, should be aware of its costs.

Making Charges

Gold Coin-Making charges can range from 5% to 10%.

Jewellery- Making charges start from 12% and can go as high as 25%.

Digital Gold- 3% GST at the time of purchasing and 4%-5% spread at the time of selling.

Most sellers don’t disclose this spread at the time of purchase.

For example, if you buy gold worth Rs.100, you will have to pay 103(including GST), and when selling(supposing at the same rate), you will receive 95.77.

The total cost comes to around 7%(one time).

Gold Bar/Biscuit- Making charges are close to 5%.

Gold ETFs-Expense is .5%-1% per year.

SGB(Soverign Gold Bond)-Broker charge of 0.01% or Rs.20, whichever is lower.

Besides this, we have GST, which is 3% for all physical and digital gold purchases.

Imagine you have bought a piece of jewellery worth ₹144,000. The cost breakup would be-

22KT cost of gold = ₹125000

Making Charges =₹15000 (close to 12%)

GST(3%) = ₹4200

You have actually made an investment of only ₹125,000 in gold.

Suppose gold gives an absolute return of 50% in five years.

The value of your jewellery would be close to ₹187500 only. This is close to 8.1% p.a., whereas if you had invested in lower-cost options like digital gold or SGB, you would have mirrored gold’s performance. The cost of your investment would have been ₹2,16,000.

The only difference in the costs is that these are not recurring costs(except Gold Funds/ETFs) as charged in previous investments. But they still eat up your returns.

And therefore the one with the least charges should be preferred.

Even though we have covered a range of costs, the cost of an investment product may vary for different companies and products. The exact cost of all these products is readily available online. You should find the actual cost of an investment before investing by visiting their official page.