Comprehensive Guide to Investing in Gold : History, Forms, Benefits, Risks and Tips

Table of Contents

Gold has been a valuable and sought-after commodity for centuries and is a popular investment option in India.

In this blog, we will discuss everything you need to know about investing in gold in India, including the history of gold in India, the various forms of gold investments available, the benefits and risks of investing in gold, and how to make the most of your gold investments.

History of gold in India

Gold has been an integral part of Indian culture for thousands of years. It has been used for monetary and ornamental purposes since ancient times.

In the Vedic period, gold was considered a symbol of wealth and prosperity, and it was used to make jewellery and other decorative items.

The use of gold as currency can be traced back to the 6th century BC in ancient India. The gold coins known as “dinars” were used as a medium of exchange and widely accepted as a currency.

The use of gold as the currency continued through the Mughal period and even during the British colonial rule in India.

Even today, gold remains an important part of Indian culture and is widely used in jewellery and other decorative items.

It has a special place in Indian weddings and other ceremonies as a symbol of wealth and prosperity.

Various forms of gold investments available

- Physical Gold: This includes buying gold coins, bars, or jewellery.

- Gold ETFs (Exchange-Traded Funds): These funds track the price of gold and can be bought and sold on stock exchanges.

- Gold Mutual Funds: These funds invest in companies involved in gold mining or other gold-related industries.

- Sovereign Gold Bonds: These are bonds issued by the government of India that is linked to the price of gold.

- Digital Gold: This is a new form of investment, where you can buy and sell gold online through digital platforms.

Role of gold in a good portfolio

Gold can play a vital role in a well-diversified investment portfolio.

It acts as a hedge against inflation and provides a safe haven for investments during times of economic uncertainty.

The low correlation of gold with other asset classes, such as stocks and bonds, makes it an ideal diversifier for a portfolio. It helps to reduce overall portfolio volatility and improves the overall risk-return characteristics of a portfolio.

Gold can also provide a source of long-term growth, providing investors with a source of capital appreciation. It also serves as an effective diversifier during economic downturns, currency fluctuations, and geopolitical uncertainties.

Overall, it is important to consider the role of gold in a portfolio and allocate a small percentage of the portfolio to gold to achieve optimal diversification and risk-return trade-off.

How much money should be invested in gold

The amount of money that should be invested in gold can vary depending on an individual’s investment goals and risk tolerance.

Generally, allocating 5-10% of your portfolio to gold is recommended.

However, it is important for you to consult a financial advisor to figure out the appropriate allocation for your situation.

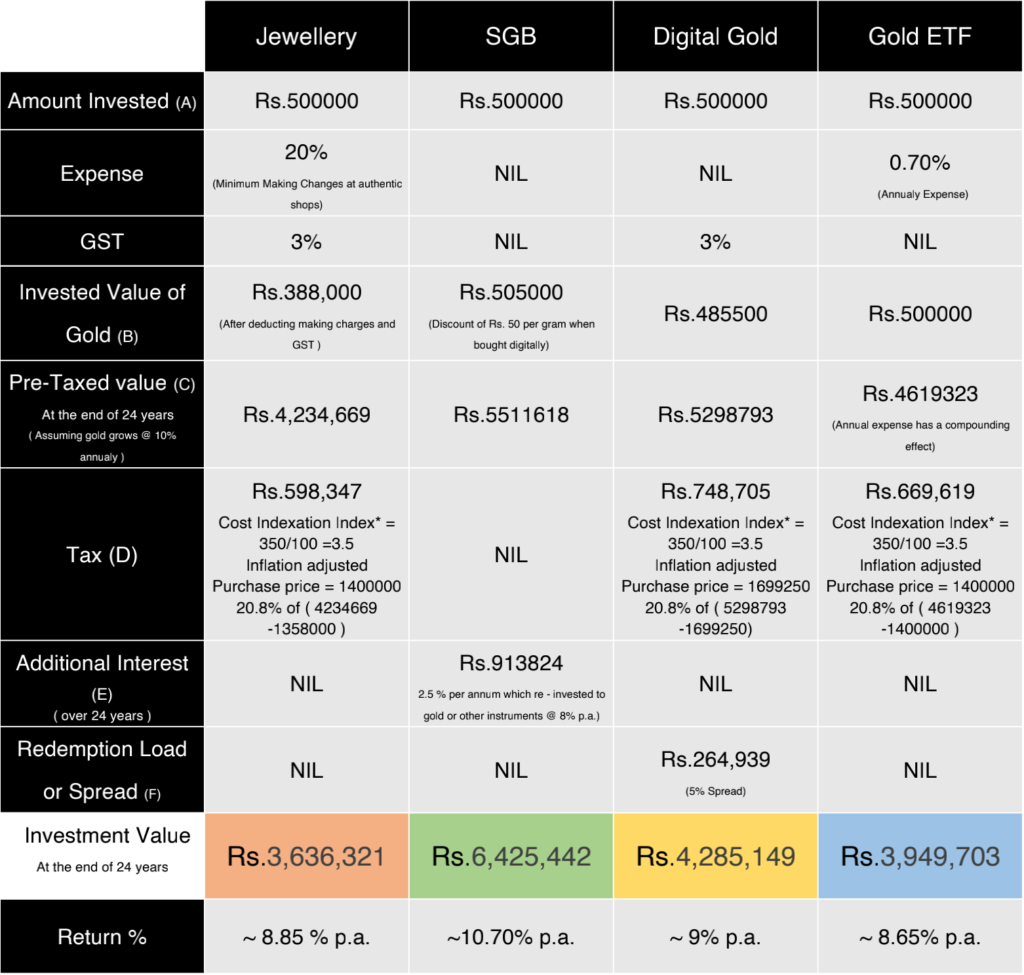

Which form of gold is best to buy in India

Physical gold, such as gold coins or bars, is a popular option as it can be easily stored and transported.

Gold ETFs and gold mutual funds are also popular options as they provide the convenience of buying and selling gold on stock exchanges.

However, one of India’s most popular and favourable forms of gold investment is Sovereign Gold Bond (SGB).

Sovereign Gold Bonds (SGBs) are government securities denominated in grams of gold. They offer a number of benefits over physical gold, such as ease of holding and trading, interest income and capital appreciation.

They also provide an additional advantage of capital gains tax exemption on redemption.

A combination of Sovereign Gold Bonds (SGBs) and Gold ETFs or Digital gold can be an excellent option to gold investors. While SGBs offer an additional 2.5 per cent interest, ETFs/digital gold provide better liquidity.

Quick tips before you start investing

Avoid making investment decisions based on the recent performance of gold or personal traditions.

For long-term investments (over 8-10 years), consider Sovereign Gold Bonds (SGBs) as a better option.

Gold Exchange Traded Funds (ETFs)/ Digital Gold offer better liquidity.

Investing in gold via monthly systematic investment plans (SIPs) through mutual funds can also be considered.

Always ensure that you are buying gold from a reputable dealer or institution to avoid fraud and ensure the authenticity of the gold.

Keep in mind that gold prices can be volatile and may not always move in the direction you expect. Having realistic expectations and not investing more than 10% of your portfolio is important.

Overall, gold can be a good addition to a diversified investment portfolio, but it’s important to invest in it with a long-term perspective and not be swayed by short-term market fluctuations.

It’s also important to consult with a financial advisor to determine the right allocation of gold in your overall portfolio based on your individual financial situation.