Our Investment Strategy

Our investment methodology incorporates our investment philosophies and beliefs, such as the benefits of low costs, diversification, and indexing. Our methods, which are periodically reviewed, are based on various internal and external sources. Our methodology is driven by long-term financial goals, not market-timing or short-term investment performance.

Rather than attempting to predict which investments will provide superior performance at any given time, Credible believes it can provide the best opportunity for success by maintaining a broadly diversified Portfolio, including investments in a variety of market sectors and asset classes.

We rely on the information you provide and on certain assumptions based on our analysis of future financial factors, such as rates of return on certain types of investments, inflation rates, savings rate, percentage of income needed in retirement, portfolio withdrawals, tax rates, taxable capital gains and losses, education costs for your children, and market returns, to create an investment strategy for you.

All the assumptions are estimates based on historical data and forecasts that, in our opinion, serve as a valuable and reasonable foundation for developing financial strategies.

First, we’ll gather information through a risk quiz and investor profiler to understand your financial objectives, risk tolerance, specific financial goals, time horizon, current investments, tax rate, other assets and sources of income, investment preferences, and planned spending.

A proprietary algorithm uses this data to recommend a particular investing profile and the corresponding investing path that considers the risk tolerance, asset allocation, and time horizon suitable for your goals. The investing profile ranges from Conservative, Moderate, Balanced, Growth and Aggressive.

The paths within each profile are designed to change over time to adjust your risk exposure and asset allocation to match the time remaining for each of your specified goals.

Our investment strategies are designed with a disciplined, long-term approach focused on managing risk through appropriate asset allocation and diversification.

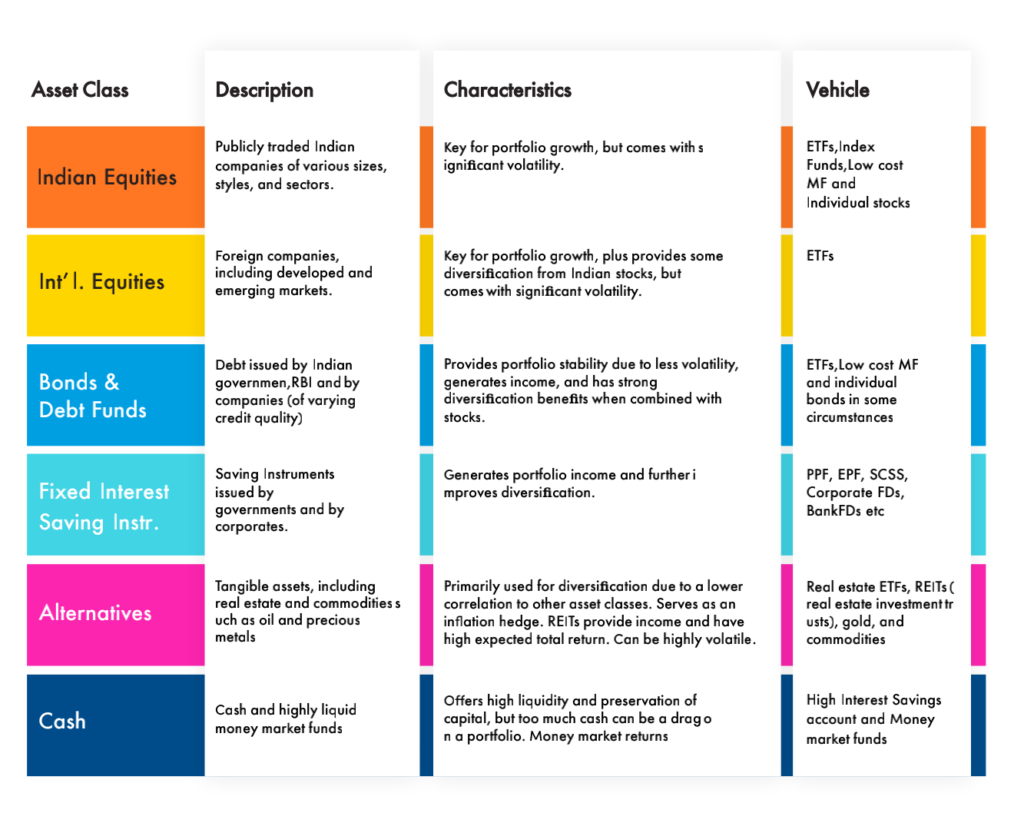

Our methodology uses a strategic approach by focusing on the mix of asset classes (i.e., domestic equity, international equity, debt, alternatives and cash) that align with your willingness and ability to take the risk and are appropriate to meet your financial goals over time.

When recommending, setting, and adjusting your asset allocation, we weigh “shortfall risk”—the possibility that a Portfolio will fail to meet longer-term financial goals—against “market risk,” or the chance that a Portfolio’s value will fluctuate based on the market’s ups and downs. Investment strategies for different goals may reflect trade-offs between shortfall and market risk.

An investment strategy that’s too conservative raises the risk that inflation will erode the purchasing power of a long-term portfolio. Appropriate asset allocations may range from 100% equity to 100% debt based on the risk tolerance and remaining investment time horizon for a particular financial goal.

All of our model portfolios are designed to maintain an optimal balance of risk vs return for each individual, aiming to give our clients the best chance of meeting their goals.

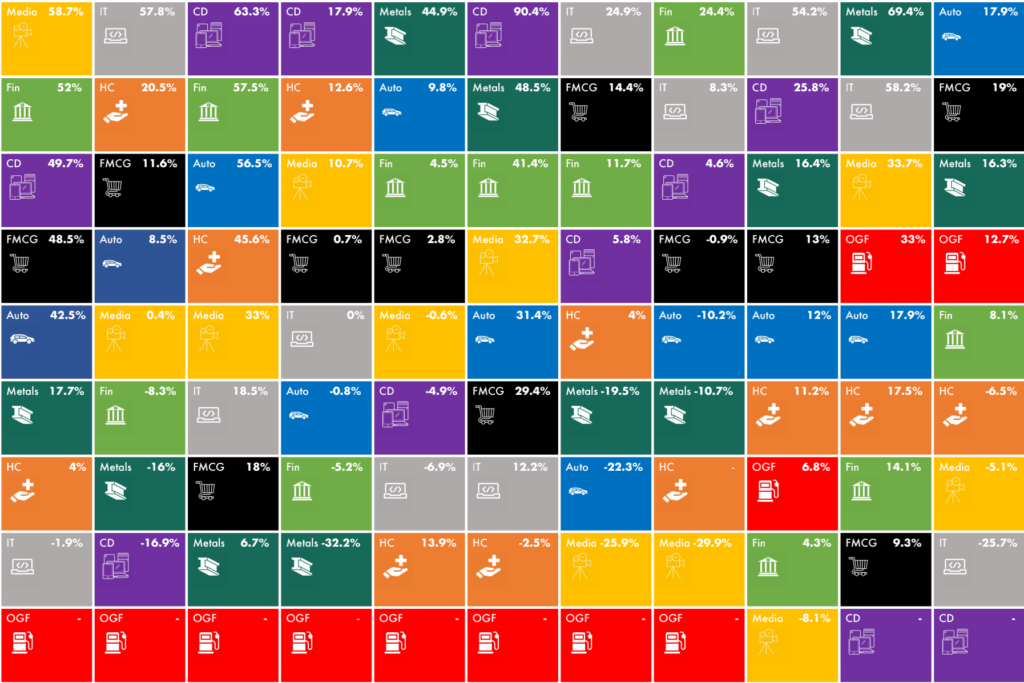

We seek to provide adequate diversification within each asset class. We recommend investing across different market segments to ensure sub-asset class diversification.

Equity

Our equity methodology seeks to diversify across different market segments (e.g., domestic and international; large, mid, and small-cap; and growth and value). While investing in equity securities can help grow your wealth over the long term, stock markets are also volatile, and you may lose money in a sharp downturn that can occur without warning.

We ensure the Portfolio isn’t too heavily concentrated in one or more industry sectors, countries, or market segments.

Debt

Though our first preference on the debt side would be fixed return products like EPF, PPF, Corporate FDs etc., if your Portfolio needs more debt investments based on your asset allocation, we will follow the below methodology.

Our bond methodology emphasises diversification across the domestic bond market and maintains an interest rate risk exposure in line with the overall bond market.

Bond investments are subject to multiple risks, including interest rates, credit, and inflation. Diversification across the domestic bond markets and market segments, issuers, and the yield curve helps mitigate these risks.

Our lead bond recommendation builds diversified Portfolios across short-, intermediate-, and long-maturity bond funds and seeks to maintain an intermediate-term duration.

An intermediate-term duration generally means your Portfolio stays in the middle of the spectrum when measuring its sensitivity to interest rate changes while maintaining exposure to all areas of the maturity range.

We do not believe in a fund manager’s ability to beat the market as, time and again, it has been proven that most of the active funds underperform the index.

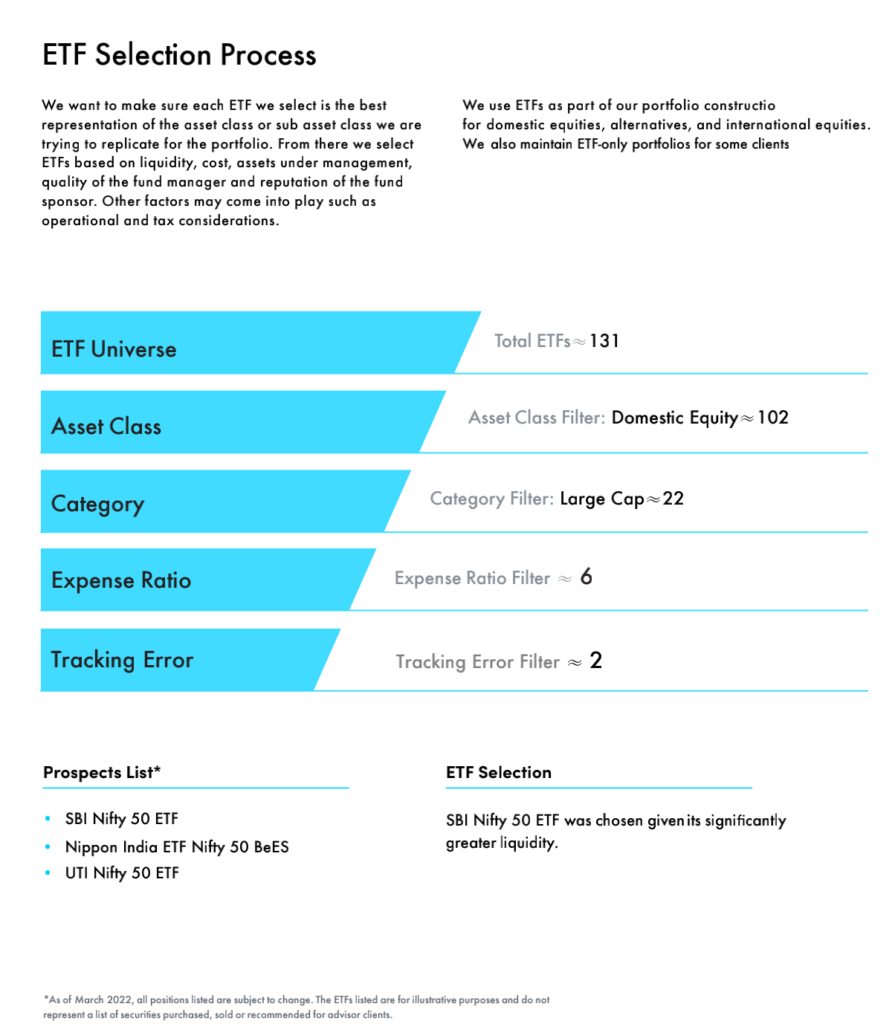

Index funds and ETFs form the core of our client portfolio.

After determining the overall asset mix and your equity, debt and alternative sub-allocations, we will recommend appropriate investments for your Portfolio primarily consisting of low-cost Funds and ETFs.

A sample ETF selection strategy would be somewhat like this

We approach fund selection with a long-term, buy-and-hold approach and discourage switching strategies based solely on recent performance. However, we may recommend reallocating holdings among different Funds as we periodically reassess the most appropriate investments to achieve the targeted asset allocation and sub-allocations

We will attempt to construct your Portfolio to fulfil your fixed income allocation in tax-saver instruments like EPF, PPF, SSCS etc., unless you already hold debt allocations that align with our portfolio construction methodology.

We recommend holding active equity funds in your Portfolio first in tax-exempted instruments like ELSS and NPS, subject to remaining capacity after your Portfolio’s target debt allocation has been fulfilled in those exemption categories.

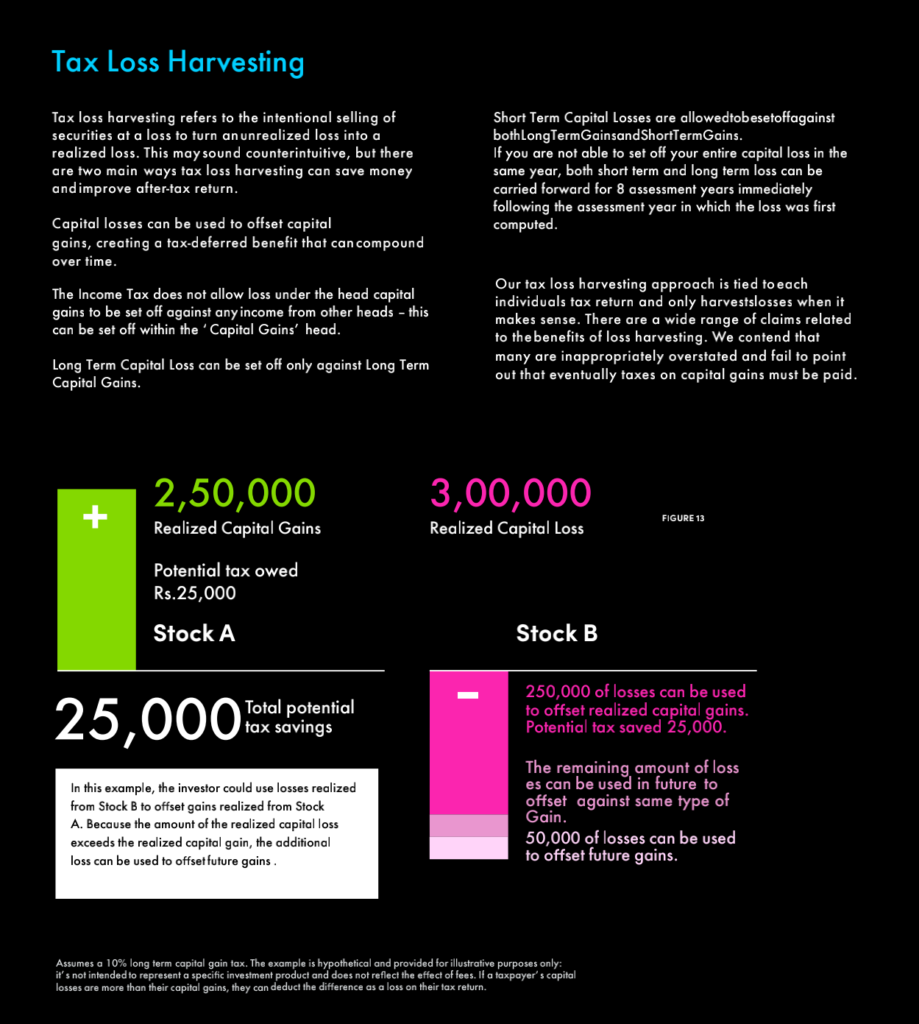

We’ll modify our approach to tax-efficient investing based on any changes in tax laws.

Each quarter (with timing determined and agreed upon with the client), we will review your target allocation as illustrated in the asset allocation schedule in your financial plan with your investment time horizon to determine if any changes in the target asset allocation you approved as part of your ongoing financial plan are recommended.

Suppose we recommend changes to the Portfolio’s target allocation. In that case, we may purchase or sell the securities in the Portfolio to meet the new target asset allocation.

Suppose your ability to bear risk, investment time horizon, financial situation, or overall investment objectives change. In that case, you should notify us so that we can take these considerations into account when reviewing your asset allocation target.

We won’t change the recommended asset allocation based on current or prevailing market conditions. Still, We may recommend a different asset allocation based on changes to your financial situation or investment objectives.

When requesting a financial plan, you can impose reasonable restrictions on the investments recommended for the financial plan or Portfolio.

Specifically, you can request that certain alternate Funds and non-Indexed funds be held as part of the financial plan or the Portfolio, provided those securities meet specific standards, including our portfolio construction and diversification standards established by us for such holdings.

You will also be able to designate specific funds or securities that shouldn’t be recommended for the Portfolio or that shouldn’t be sold if held in the Portfolio.

We may discuss particular investing preferences you may have. For example, an active versus passive tilt or limits on certain sub-asset allocation percentages, among other choices.

Specifically, you can request:

• A variance in the percentages of your equity allocation invested in domestic versus international funds (subject to our allowable variance ranges).

• A variance in the percentages of your international equity allocation invested in developed versus emerging markets (subject to our allowable variance ranges).

• A variance in the percentages of your bond allocation invested in domestic versus international funds (subject to our allowable variance ranges).

• An active domestic bond allocation instead of an indexed approach.

Clients may request that we retain any company stock they previously purchased, subject to our allowable concentration limits for company stock.

*These are highlights of our detailed investment strategy. Book an appointment to receive and discuss the detailed investment strategy.