Socially responsible investing: A growing trend in India

Table of Contents

India is witnessing a significant growth in socially responsible investing (SRI), as an increasing number of investors are looking to align their financial goals with their ethical beliefs.

Understanding Socially Responsible Investing (SRI)

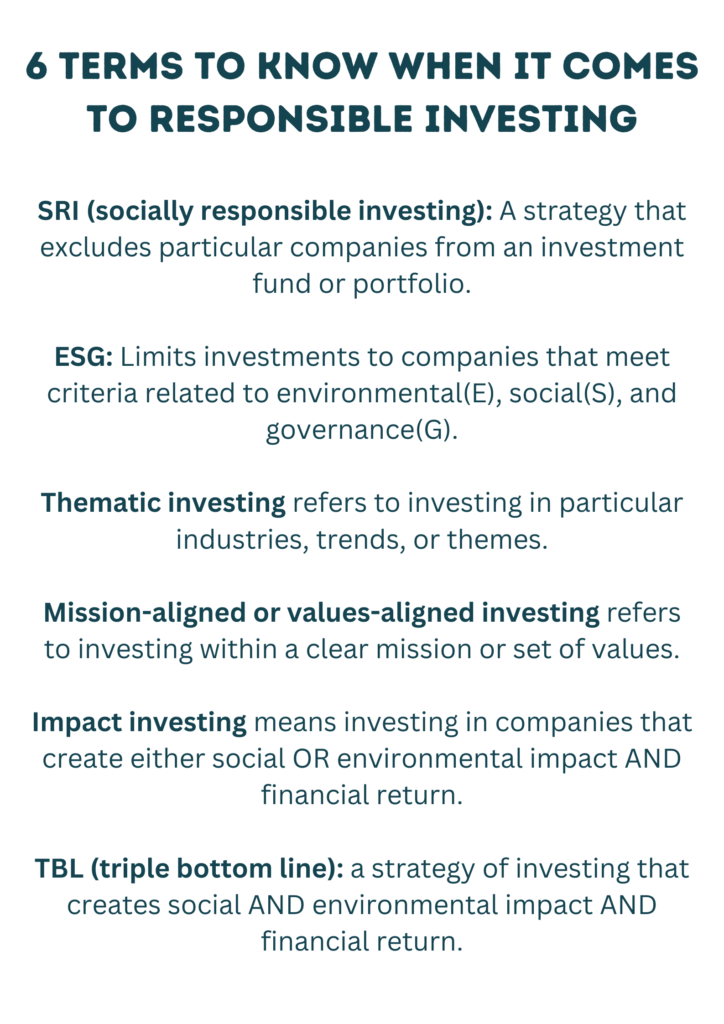

SRI is an investment strategy that seeks to generate both financial returns and positive social or environmental outcomes. It involves selecting investments based on a set of ethical criteria, which may include factors such as environmental sustainability, social justice, corporate governance, and ethical business practices.

SRI investors often exclude companies involved in industries like tobacco, alcohol, gambling, or weapons manufacturing due to their potential negative social impacts.

The Growth of SRI in India

The Indian market has seen a surge in interest in SRI over the past few years. This growth can be attributed to several factors:

Increasing awareness: A rise in social and environmental consciousness among the Indian population has led to a growing demand for investments that reflect these values.

Regulatory push: Indian regulators have been proactive in promoting sustainable business practices, including the introduction of mandatory ESG disclosures for listed companies and the adoption of stewardship codes for institutional investors.

Market performance: SRI funds in India have demonstrated competitive financial returns, attracting a broader range of investors.

Global trends: As SRI gains popularity worldwide, international investors are increasingly seeking SRI opportunities in emerging markets like India.

How SRI is different from ESG

While SRI and ESG investing share some commonalities, there are key differences between the two:

Focus: SRI emphasizes a broader range of ethical considerations, including social, environmental, and moral factors.

ESG, on the other hand, concentrates primarily on environmental, social, and governance criteria that can directly impact a company’s financial performance and risk profile.

Investment approach: SRI often employs negative screening to exclude companies involved in industries or practices deemed harmful to society or the environment.

ESG investing typically involves a more nuanced approach, evaluating companies based on their ESG performance relative to industry peers and integrating this analysis into the investment process.

Goal: While both SRI and ESG investing aim to promote responsible business practices,

SRI goes a step further by seeking to generate positive social and environmental impacts alongside financial returns.

ESG investing, in contrast, focuses on identifying and managing ESG risks and opportunities to enhance long-term value creation.

Best Practices for SRI investors in India

For investors interested in adopting an SRI strategy in India, here are some best practices to consider:

Define your values: Clearly articulate your ethical and financial objectives to ensure your investments align with your beliefs.

Conduct research: Investigate the SRI landscape in India, including available funds, indices, and investment products that match your criteria.

Engage with companies: Actively participate in shareholder meetings, vote on resolutions, and communicate with companies to encourage better social and environmental practices.

Monitor performance: Regularly review your investments’ financial and social impact performance to ensure alignment with your goals.

Seek professional advice: Consult with financial advisors experienced in SRI to help navigate the complexities of socially responsible investing.