Look Beyond the Job: Think before Making Your Career Your Entire Identity

This blog explores the negative consequences of basing one’s entire identity on their career, providing insights into the dangers of such a mindset. The article offers guidance on how to cultivate a healthy work-life balance and find meaning and fulfilment outside of work.

Unlocking the Power of Compounding: A Guide to Maximising Returns over Time

Maximize returns over time with the power of compounding. Learn how to unlock its full potential in our comprehensive guide. Start building your wealth today.

Lessons from Warren Buffet’s Annual Letters: A Guide to Improving Investment Strategies

Discover the valuable lessons from Warren Buffet’s annual letters and how to apply them to improve your investment strategies. Learn the importance of long-term thinking, value investing, and strong management from one of the most successful investors of all time.

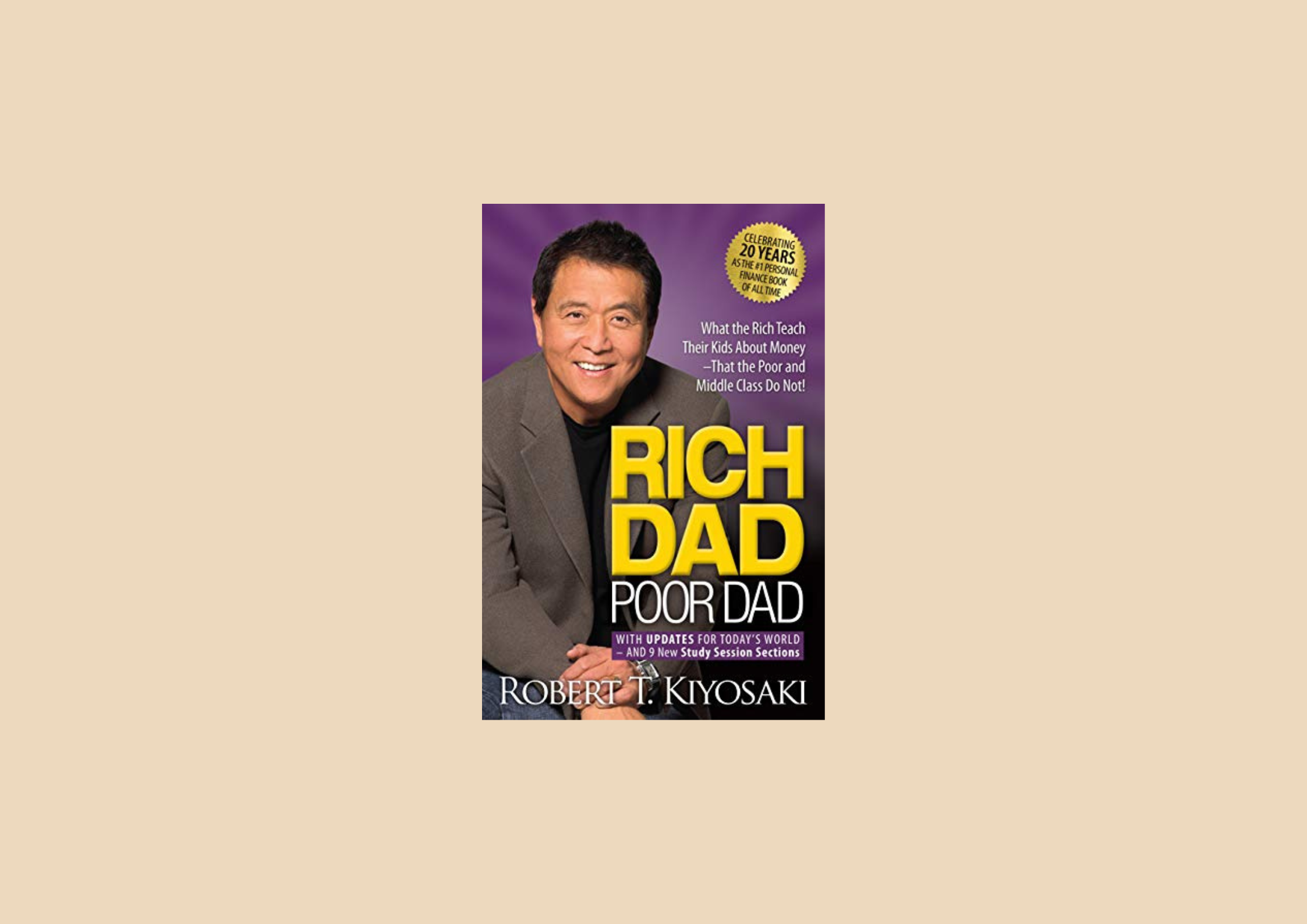

Mastering Your Finances with Rich Dad: Lessons for Building Wealth and Financial Independence

Learn how to understand the difference between assets and liabilities, build a strong financial foundation, acquire assets, take calculated risks, build passive income, achieve financial independence, leverage, plan and network.

Wealth Management for Non-Residents in India: Tips and Strategies

This blog post offers tips and strategies for effective wealth management in India, including financial planning, tax planning, and investment options.

Tax Planning Tips for Investors in India

Stay compliant and save money on taxes with these expert tips for Indian investors. From understanding tax laws to finding deductions and credits, this blog offers practical guidance on how to optimize your investment returns through smart tax planning.

A Guide to Understanding Financial Product Costs

In this blog, we provide an overview of the various financial products available in the Indian market and their associated costs. From life insurance and mutual funds to NPS, we outline the fees and charges that you can expect to pay. By understanding the costs of different financial products, you can make informed decisions about which ones are right for you and your financial goals.

Why you need a Financial Advisor in India?

In this blog, we explore the benefits of working with a financial advisor and how they can help you make informed decisions about your financial future. From creating a budget and investing for the future to navigating complex financial products, a financial advisor can provide expert guidance and support.

The Real Benefit of Hiring a Financial Advisor

Discover the true benefit of hiring a financial advisor beyond potential investment returns. Learn how delegation can lead to time-saving, expertise, informed decision-making, and stress reduction in financial planning.