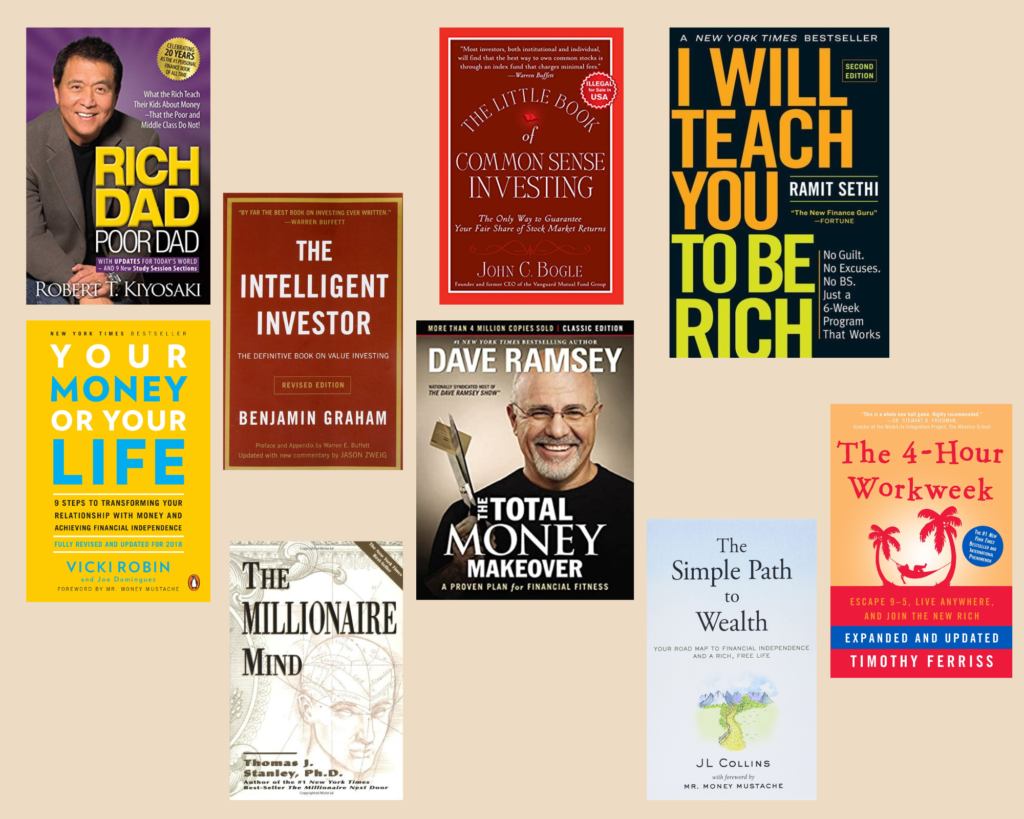

The Ultimate Guide to Building Wealth and Managing Your Finances: Learn from the Top 9 Personal Finance Books

These books have been carefully selected based on their ability to provide practical, actionable advice that can help you improve your financial literacy, understand complex financial concepts, and make informed decisions about your money.

Whether you’re just starting out on your financial journey or looking to take your knowledge to the next level, these books offer something for everyone. So, buckle up and get ready to learn about the best lessons on personal finance from some of the world’s foremost experts.

1. Building wealth requires a change in mindset and understanding the difference between assets and liabilities.

It’s important to focus on acquiring assets that generate income or appreciate in value, such as rental properties or stocks, and avoiding liabilities that drain your resources, such as credit card debt or a car loan.

2. Creating multiple streams of income is essential for financial freedom.

This can include having a well-paying job, starting a business, renting out a property, or investing in dividend-paying stocks.

The key is to have multiple sources of income so that you are not dependent on just one.

3. Saving and investing money consistently is key to building wealth over time.

It’s important to set a budget and stick to it and to make sure that you are putting enough money into savings and investments each month to reach your financial goals.

4. Understanding the power of compound interest and how it can grow your money.

Compound interest is the interest on interest, and it can make your money grow exponentially over time.

By starting to save and invest early, you can take advantage of compound interest to help your money grow more quickly.

5. Living below your means and avoiding lifestyle inflation can help you save more money.

It’s important to be mindful of your spending and to avoid increasing your expenses as your income goes up.

By living below your means, you can save more money each month and put it towards your financial goals.

6. Eliminating debt and avoiding unnecessary borrowing can improve your financial health.

Carrying a high amount of debt can be a significant burden on your finances, and it’s important to take steps to pay it off as soon as possible.

Avoiding unnecessary borrowing, such as taking out a loan for a luxury item, can also help you stay out of debt in the long run.

7. Diversifying your investments can help reduce risk and increase returns.

Diversifying means spreading your money across different asset classes, such as stocks, bonds, and real estate, and different sectors, such as technology, healthcare, and energy.

This can help you spread out the risk and increase your chances of earning a higher return on your investments.

8. Having a long-term investment strategy is more effective than trying to time the market.

Instead of trying to predict the market’s ups and downs and making impulsive investment decisions, it’s more effective to have a long-term investment strategy in place, such as rupee-cost averaging and sticking to it.

9. Educating yourself about personal finance and investing is important for making informed decisions.

It’s important to take the time to learn about different investment options, how to read financial statements, and how to create a budget.

The more you know about personal finance and investing, the better equipped you will be to make wise financial decisions.

10. Setting clear financial goals and creating a plan to achieve them can help you stay on track.

It’s important to have specific, measurable, and realistic financial goals in place, such as saving for a down payment on a house or retirement.

Having a plan in place for achieving these goals can help you stay focused and motivated as you work towards them.

11. Understanding the concept of risk and return and how they are related is crucial for making investment decisions.

Every investment comes with a certain level of risk, and it’s important to understand how that risk can affect the potential returns.

It’s also important to understand that higher potential returns often come with higher risk.

12. The importance of budgeting and keeping track of your expenses to manage your money effectively.

Having a budget in place can help you see where your money is going and identify areas where you can cut back.

Keeping track of your expenses can also help you identify any issues or patterns that may be causing financial strain and make adjustments as needed.

13. The power of negotiation and how it can help you save money in various aspects of your life.

Whether it’s negotiating a higher salary at work or haggling for a better price on a big purchase, learning how to negotiate can help you save money and get the best deals.

14. The importance of having an emergency fund to cover unexpected expenses.

Unexpected events such as job loss, medical emergencies, or home repairs can happen, and having an emergency fund in place can help you cover those expenses without going into debt.

15. The benefits of automating your savings and investments to make it easier to build wealth over time.

By setting up automatic transfers from your checking account to your savings or investment accounts, you can ensure that you are consistently putting money away for the future without having to think about it.

16. The impact of taxes on your finances and how to minimise them.

Understanding how taxes work and taking advantage of tax-advantaged accounts and deductions can help you keep more of your money and potentially lower your tax bill.

17. The importance of having insurance to protect yourself financially.

Having insurance can help protect you financially in the case of an accident, illness, or other unexpected events.

It’s important to understand the different types of insurance available and to have the right coverage in place to protect yourself and your family.

18. How to build a successful business and create multiple streams of income.

Starting a business or becoming an entrepreneur can be a great way to create multiple streams of income and achieve financial freedom.

It’s important to have a clear business plan and to be willing to take calculated risks in order to succeed.

19. The importance of understanding and managing your credit score.

Your credit score can have a big impact on your finances, from getting approved for a loan to getting a good interest rate.

It’s important to understand how credit scores are determined and to take steps to improve your score if needed.

20. The benefits of living a frugal lifestyle and how it can help you save money.

Being mindful of your spending and finding ways to save money on everyday expenses can help you stretch your budget further and reach your financial goals faster.

21. The importance of developing good money habits and avoiding financial mistakes.

Habits such as living below your means, saving regularly, and avoiding unnecessary debt can help you build wealth over time.

Avoiding common financial mistakes, such as overspending or not saving enough, can also help you stay on track.

22. The benefits of saving for retirement early and taking advantage of compound interest.

The earlier you start saving for retirement, the more time your money has to grow through compound interest.

It’s also important to have a clear plan in place for how you will use your retirement savings and how much you will need to save to reach your goals.

23. The importance of having a plan for passing on your wealth to future generations.

It’s important to have a plan in place for how you will pass on your wealth to future generations, whether that’s through a trust, a will, or another method.

This can help ensure that your hard-earned money is used in the way you intended and that your legacy is preserved.

24. The benefits of giving back and using your wealth to make a positive impact in the world.

Giving back and using your wealth to make a positive impact in your community or the world can be a rewarding and fulfilling way to use your money.

It can also help you leave a lasting legacy and make a difference in the lives of others.

25. The importance of staying informed about changes in the economy and how they may affect your finances.

The economy is constantly changing, and it’s important to stay informed about any potential changes that may impact your finances. This can include changes in interest rates, taxes, or investment opportunities.

By staying informed, you can make adjustments to your financial plan and take advantage of new opportunities as they arise.

26. The importance of understanding the different types of investment vehicles and how they can be used to achieve your financial goals.

Different investment vehicles, such as stocks, bonds, mutual funds, real estate, and alternative investments, all have different characteristics and can be used to achieve different financial goals.

Understanding the pros and cons of each can help you make informed investment decisions.

27. The benefits of having a financial advisor or professional to help you manage your money.

A financial advisor can help you create a financial plan, manage your investments, and provide guidance on financial decisions.

They can also provide valuable insights and expertise that can help you achieve your financial goals more efficiently.

28. The importance of having a clear understanding of your risk tolerance when making investment decisions.

Every investor has a different level of risk tolerance, and it’s important to understand your own tolerance before making investment decisions.

By understanding your own risk tolerance, you can make more informed investment decisions and avoid taking on more risk than you are comfortable with.

29. The benefits of using low-cost index funds as a core investment strategy.

Index funds are a type of mutual fund that tracks a market index and are a great way to diversify your portfolio and achieve high returns with low costs.

30. The importance of having a plan for unexpected events such as job loss or disability.

It’s important to have a plan in place for unexpected events such as job loss, disability or other unexpected events.

This can include an emergency fund, insurance, and a plan for how to manage expenses during tough times.

31. The benefits of having a side hustle or freelance income to supplement your main income.

Having a side hustle or freelance income can help you increase your income and achieve your financial goals faster.

32. The importance of regularly reviewing and adjusting your financial plan as your circumstances change.

Life changes, and it’s important to regularly review and adjust your financial plan to reflect those changes. This can include changes in income, expenses, or goals.

33. The benefits of taking advantage of employer-sponsored retirement plans such as EPFs.

Employer-sponsored retirement plans can help you save for retirement, and some employers even offer matching contributions, which can be an easy way to increase your savings.

34. The importance of understanding the fees and expenses associated with different investment options.

Investment options vary in their fees and expenses, and it’s important to understand the cost of each option before making an investment decision.

35. The benefits of using technology to manage your finances and stay organised.

There are a variety of financial apps and tools available that can help you budget, track expenses, and manage your investments.

By using technology, you can stay organised and make it easier to achieve your financial goals.

36. The importance of having a plan for managing education-related debt.

Education-related debt can be a significant burden on your finances, and it’s important to have a plan in place for paying off your loans and managing that debt.

37. The importance of understanding the role of inflation in your long-term financial planning.

Inflation is the rate at which the cost of goods and services increases over time, and it can have a significant impact on your finances.

It’s important to consider inflation when making long-term financial plans and investing, as it can affect the purchasing power of your money.

38. The benefits of having a solid understanding of basic financial concepts such as cash flow and net worth.

Basic financial concepts such as cash flow and net worth are essential for understanding your financial health and making informed financial decisions.

Understanding how much money is coming in and going out, as well as your net worth, can help you make a plan to improve your finances.

39. The importance of being aware of common financial scams and how to protect yourself.

Scammers are always looking for ways to take advantage of unsuspecting individuals, and it’s important to be aware of common scams and how to protect yourself.

This can include being cautious of unsolicited phone calls or emails, not giving out personal information, and being sceptical of too-good-to-be-true offers.

40. The benefits of building a supportive community to help you achieve your financial goals.

Having a supportive community can help you stay motivated and on track as you work towards your financial goals.

This can include friends and family, a financial advisor, or a support group.

41. The importance of continually learning and staying informed about personal finance and investing.

The world of personal finance and investing is constantly changing, and it’s important to stay informed and continue learning to make informed decisions.

This can include reading books, taking classes, or working with a financial advisor.

42. The benefits of having a long-term perspective when it comes to your finances and not getting caught up in short-term market fluctuations.

The stock market and other investments can be volatile in the short term, but over the long term, they tend to trend upward.

It’s important to have a long-term perspective when it comes to your finances and not get caught up in short-term fluctuations.

43. The importance of using financial planning software to create and manage your budget, investments, and net worth.

Financial planning software can help you track your expenses, create a budget, and manage your investments all in one place.

This can make it easier to stay organised and make informed financial decisions.

Some software even comes with financial planning tools that can help you create a financial plan and forecast your future financial health.

44. The benefits of not relying on short-term gains, rather taking a holistic approach to personal finance and making financial decisions.

Relying on short-term gains can be risky and not sustainable in the long run. Instead, it’s important to take a holistic approach to personal finance and consider all aspects of your financial health, including income, expenses, debt, savings, and investments, when making financial decisions.